- The stock market is in a bubble that is being fueled by the policies out of Washington, D.C., Bank of America warned in a note on Friday.

- “Extreme policy remains best explanation for extreme rally off lows in 2020,” the firm said.

- A surge in inflation and rates could be the pin that pops the bubble, according to BofA.

- Sign up here our daily newsletter, 10 Things Before the Opening Bell.

The stock market is in a bubble that is being fueled by the policies out of Washington D.C., Bank of America said in a note on Friday.

“DC’s policy bubble [is] fueling Wall St’s asset bubble,” BofA said, adding that a rise in inflation and interest rates could be on the horizon.

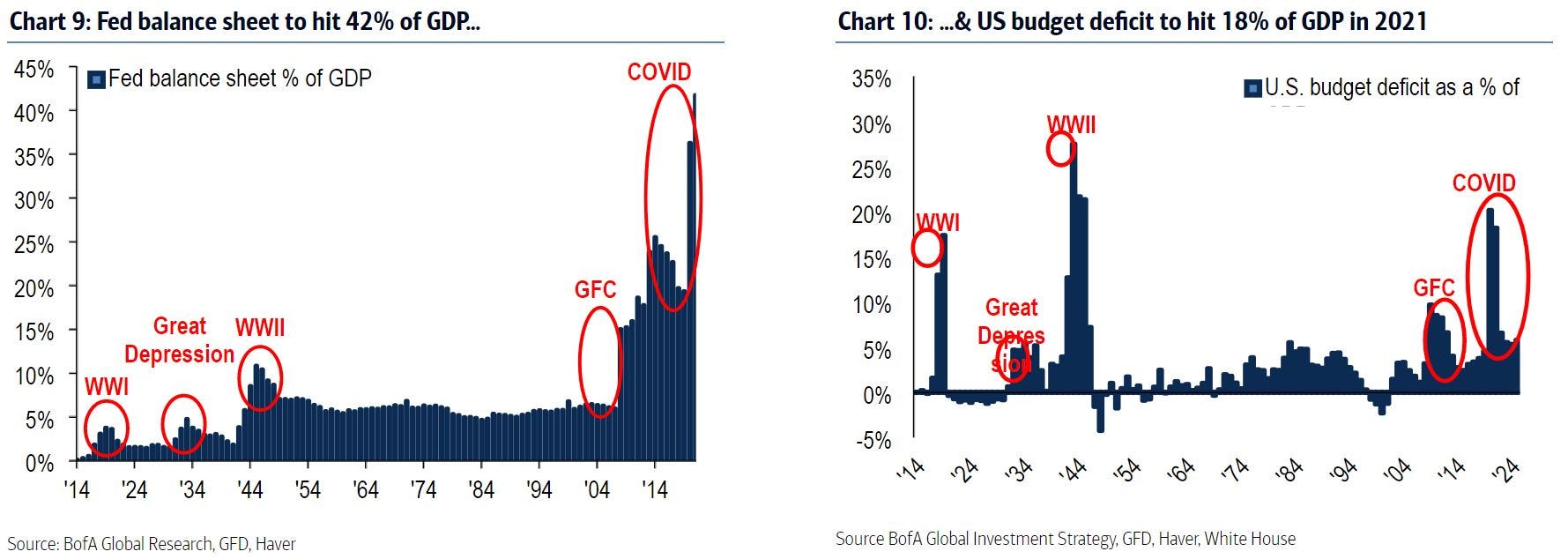

BofA is referring to the monetary policies out of the Fed, and fiscal stimulus policies from Congress. Since the COVID-19 pandemic, the Fed’s balance sheet has expanded to record levels as they continue to buy fixed income securities. The Fed also lowered the Federal Funds Rate to just above 0%.

Meanwhile, Congress has unleashed a wave of stimulus spending to help hasten the economic recovery from the COVID-19 pandemic. The stimulus policies have included direct stimulus checks to Americans, expanded unemployment insurance, and the Paycheck Protection Program.

There are no signs that the spending policies out of D.C. are going to stop anytime soon, with President Joe Biden pushing ahead with a $1.9 trillion stimulus plan and an infrastructure spending package is likely next in line.

These stimulus policies have led the Fed balance sheet to hit 42% of US GDP, while the US budget deficit is set to hit 18% of GDP, according to BofA.

But the bubble can't go on forever, BofA noted, after highlighting that inflation is likely set to make a comeback which could lead to a "disorderly rise in bond yields, tighter financial conditions, and volatility events," the note said.

But the most obvious catalyst for higher interest rates and a weaker stock market? The COVID-19 vaccine, according to BofA.

"Sell the vaccine," the bank said.